Greetings!

The other day I published a video titled Diversification is for idiots? (Why Mark Cuban Said This).

It pissed some people off!

The main points of the video:

Diversification prevents disastrous losses from one point of failure and reduces overall volatility (great for wealth preservation/slow, steady growth).

Diversification also prevents massive upside because the outperformance of a smaller holding contributes to lower overall portfolio growth compared to a more concentrated portfolio.

To build life-changing wealth *quickly*, you have to be concentrated. It’s just math. Nothing personal. Of course, concentrated portfolios are more exposed to huge losses than diversified portfolios.

High-risk investors, therefore, lean more concentrated, while low-risk investors seek more diversification.

There’s nothing wrong with taking low-risk approaches.

Not everyone is a risk-taker. Some people interpreted my video as ADVICE to not diversify, which is not valid. I would never give hard advice that can lead to complete ruin.

Levels of Diversification

In the video, I didn’t talk about the levels of diversification.

You don’t have to be all-in on one thing, and you also don’t have to be maximally diversified. You can settle somewhere in the middle and most probably do.

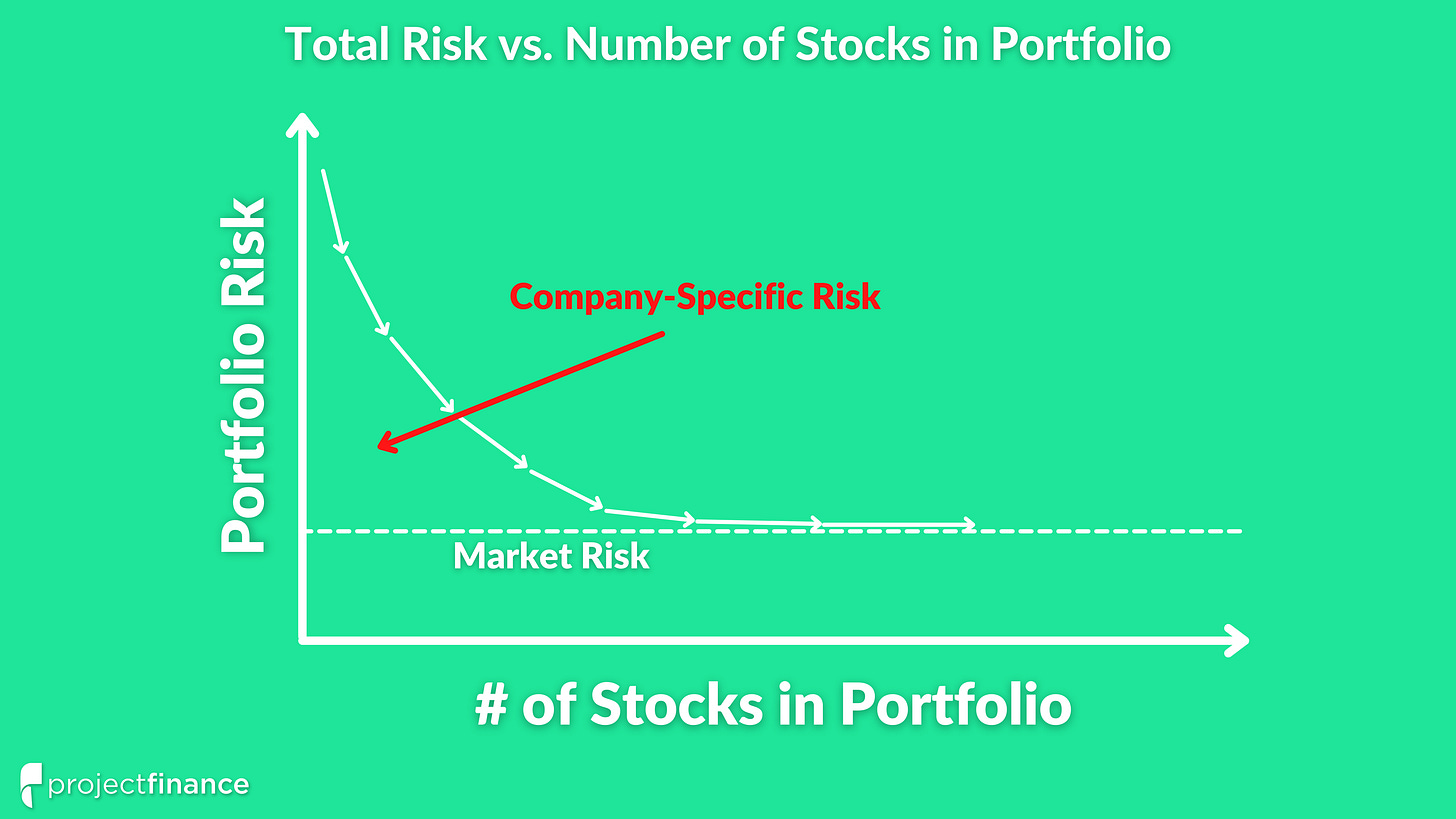

The more assets you own, the less asset-specific risk you have.

If you have 100% of your wealth in gold and it falls 25%, you lose 25%. If it goes up 10%, you grow 10%.

If you have 10% of your wealth in gold and it falls 25%, you lose 2.5%. If it goes up 10%, you grow 1%.

It’s only math.

You could put 50% of your investments in the S&P 500, 25% split into gold, bonds, and real estate. The remaining 25% could go into specific companies or cryptocurrencies. This is just a random example portfolio that is diversified but leans more concentrated than one without the 25% in specific companies or cryptos.

The potential returns of this portfolio would be far greater than having 100% in the S&P 500, and the downside potential would also be higher.

Everyone is free to craft their approach with their money: your money, your rules. Just know what game you’re playing.

If your goals are not included in the potential rewards of a game, you’re playing the wrong game.

If you’re in your early 20s with no wealth and your goal is to be a millionaire by 30, it’s virtually impossible to get there without some concentrated bet:

Investing your earnings in a small portfolio (<10 positions) high-risk stocks/assets.

Focus your time/energy on a high earnings skillset and advance your way into a multiple six-figure position.

Build and own a revenue stream (start/own a piece of a business). The business can be based on #2.

If you’re in your early 20s with no wealth and your goal is to build wealth conservatively by the time of your retirement at 65, you can certainly invest in a broadly diversified portfolio. If the highest priority is wealth preservation, spreading risk across as many assets as possible is an intelligent choice.

If the highest priority is wealth preservation, putting 50% of your investment portfolio into NFTs isn’t the right game.

Like many things in investing, there’s no one-size-fits-all approach. Money is a personal matter.

All you can do is align your goals with the potential games you can play.

You can do as Morgan Housel said and “be bold and brave, then diversify and remain paranoid.”

Or, you can diversify and remain paranoid into perpetuity.

Pick the approach that’s best for you.

-Chris