How to Hedge a Portfolio With Options?

My thoughts on the many different ways to hedge a portfolio with options.

Good morning traders!

Thanks for all of your topic suggestions in the previous email.

There were a ton of great topics, one of the top ones being hedging your portfolio with options.

I have lots of thoughts on hedging with options, so we’ll tackle that today.

Hedging Products & Strategies

There are go-to products/strategies that come to mind when I think of hedging my portfolio with options:

Equity Index ETFs: SPY, IWM, QQQ

Volatility Products: VIX options, VXX

Biggest Portfolio Positions

Zero-Cost Hedging on Profitable Stock Positions

I’ll save the best for last!

Equity Index ETFs

The most straightforward products to use for hedging purposes are equity index ETFs like SPY or IWM because they represent the broad stock market.

If the “stock market crashes,” it means these products are collapsing, and therefore long puts on these products will explode.

But which puts do you buy, and in what expiration?

Tricky question.

I see two approaches:

1) Buy shorter-term puts and keep repurchasing puts as each round expires.

2) Buy longer-term puts and re-hedge less often.

Universa Investments incorporates a shorter-term put purchasing strategy each month. But they lost money for over 10 years before hitting it huge on one of their “tail hedges.” We should expect the same consistent losses when buying index puts.

Hedge Time Frame

Let’s look at the current SPY chart:

The index is currently slipping, and maybe some of you want to hedge your portfolios to protect against a rug pull.

The 400-strike 37-day puts are trading for about $250 each:

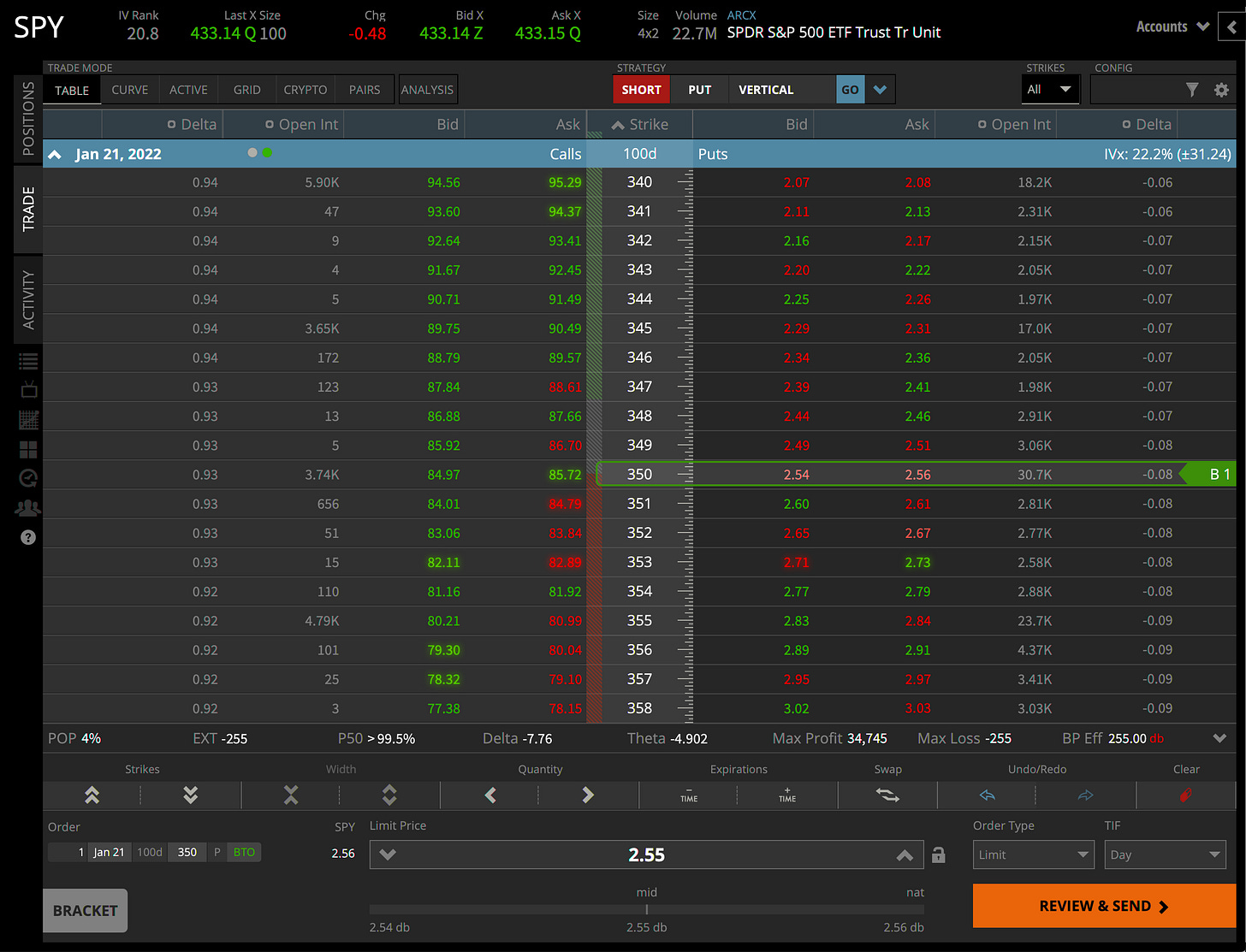

Meanwhile, the $250 puts in the 100-day cycle (Jan 2022) are at the 350 strike:

There’s no right or wrong answer. The point is, if you buy longer-term protection, it’s going to be a lot more expensive unless you buy deeper OTM strikes, requiring a much larger market decline to get the same level of protection.

I think a better question than “which puts should I buy/what expiration" is “what am I hedging against?”

Are you trying to protect against a complete catastrophe or a moderate decline in the market?

If I was trying to protect against a complete catastrophe, I would buy much deeper OTM options with a higher contract quantity:

These 200 and 300 puts in the Jan 2022 cycle are super deep OTM, but they will explode in value if the market crashes hard over the next couple of months. I’m more concerned about a massive market decline than a shallow one.

Most likely, the puts will expire worthless, which should be an acceptable outcome if you are truly hedging instead of trying to make money from a market decline (two different things).

Volatility Products

In the volatility product realm, I prefer VXX call options as the hedging instrument.

VXX tracks the daily percentage change of the near-term VIX futures, which increase in the event of a market crash:

The surge in VXX is from the mayhem in 2020. Traders who owned calls in VXX during that time frame printed money.

Like SPY puts, VXX calls are going to lose money unless the market dumps and volatility spikes.

They are also very expensive. With VXX currently at $24.50, the 37-day 30-strike calls are $150 each.

The 30 strike is 20% above the current price of VXX, which means the calls will expire worthless if the near-term VIX futures don’t increase by 20%+ in the next month.

VXX Decay

VXX is a different animal than SPY because VXX tracks the daily percentage changes of the near-term VIX futures.

This matters because as VXX decays to lower prices, we need a significantly higher vol spike to get back to the call strike we purchase.

For instance, if VXX is at $25 and I buy the 30-strike calls, I need a 20% increase in the near-term VIX futures for VXX to get to my call strike.

But if market volatility collapses and VXX decays to $20 in the next two weeks, now I need a 50% spike in vol to get to my strike price of $30.

As VXX decays, the higher the vol spike needs to be to get back to the call strike.

For this reason, I prefer to buy shorter-term calls on VXX so that my call strike remains closer to VXX as it decays during calmer market periods. Here’s a simple visualization to illustrate what I mean:

If we consider a scenario where I buy a longer-term call at the first strike (left-most strike), the option would still be OTM during the VXX spike due to the VXX decay over time followed by a spike.

If I buy shorter-term calls at strikes that follow VXX downwards during normal market environments, my strike will be in a better position (lower) when VXX eventually does rise.

A benefit of using VXX calls to hedge is that VXX can increase exponentially during a turbulent market period (see: 2020).

Since VXX tracks daily percentage changes of near-term VIX futures, the dollar value of VXX compounds during a severe market correction combined with a sustained period of high volatility where the VIX futures are in backwardation (VIX Index > VIX futures).

For example, if VXX is at $25 and near-term VIX futures spike 50% (20 to 30), VXX will go to $37.50 on that day.

If the futures spike another 50% the next day (30 to 45), VXX goes from $37.50 to $56.25.

Here’s where the exponential gains come in.

If the VIX is at 50 and the near-term VIX futures are at 45, they will drift to 50 as time passes if market volatility / the VIX remain elevated.

That means VXX will drift up another 10% to $60+. If the elevated vol continues, VXX will continue drifting upwards.

Sustained periods of high volatility are rare and don’t last forever, but the math is in favor of VXX during those times, making call options highly effective hedging instruments. Market participants are aware of this, making VXX calls pricey when market volatility is high.

Biggest Portfolio Positions

Instead of using products like SPY or VXX to hedge a portfolio, you can always just hedge your largest portfolio positions. If the market crashes, your largest positions will lose the most money, making those positions a good place to put in protective trades.

In my primary speculative trading account, the largest positions are MSTR and SQ.

If I’m trying to hedge my portfolio against a market decline, I can just focus on those two positions.

Most of the value in the MSTR and SQ positions are shares of stock, which I’m not really concerned about hedging since those are long-term holds.

MSTR

If I wanted to hedge MSTR, I could buy puts, short calls against my profitable call positions, do a costless collar on the shares, or simply take profits on a portion of the position to reduce the size.

We can look at the two call spread positions (the 500/800 and the 600/1000 call spreads) to see what I mean regarding shorting calls against profitable call positions.

The 500 call was purchased for $7,800 and the 800 call was shorted for $10,380.

If we can imagine a scenario where I never shorted the 800 call against the 500 call, then the position would have $10,380 more in risk.

By shorting the 800 call for $10,380, I reduced the overall risk in the position by that amount because if MSTR is below $800 in 65 days, the 800 call will expire worthless and I’ll make $10,380 on that portion of the trade.

Same thing with the 600/1000 call spread. I bought the 600 call for $8,995 and shorted the 1000 call for $7,940. The position’s risk fell by $7,940 when I shorted that call. If MSTR is at $600 when those options expire in 100 days, the 600 and 1000 calls will expire worthless.

If I only had the 600 call, I’d lose $8,995 based on my purchase price of that call. But since I shorted the 1000 call for $7,940, I’ll make $7,940 if MSTR is at $600 in 100 days, reducing my exposure.

Zero-Cost Hedging on Profitable Stock Positions

If you have profitable stock positions with at least 100 shares, you can create zero-cost hedges by using the costless collar strategy.

Mark Cuban famously used this strategy to protect his payout of Yahoo! stock when he sold his company Broadcast.com.

The costless collar consists of shorting a call option and buying a put option for no cost.

Let’s look at how that works on my SQ stock position:

I have 200 shares of SQ purchased for $190/share. They are currently at $242/share.

If I wanted to protect my stock position without any costs through January 2022, I could do something like the following trade:

If I short the 300 call for $4.50 and buy the 190 put for $4.50, I create a costless collar because the short 300 call finances the purchase of the 190 put.

It’s basically a covered call where you buy a put less than or equal to the credit of the call.

With this setup, I’ll protect 100 shares below $190/share (the strike of the put), but I may have to sell my shares if SQ rallies above $300 by the time of expiration. I have 200 shares of SQ, so I could short 2x calls and buy 2x puts to fully hedge the share position.

Since I paid $190 for the shares initially, this particular trade setup guarantees that I do not take a loss on the shares through January 2022 because the put strike is at $190 (my purchase price).

Mark Cuban used this strategy because he had a lockup period that prevented him from selling his shares. To protect against the possibility of Yahoo! shares crashing and significantly devaluing his payout before he could sell, he implemented the collar strategy to lock in a minimum share sale price (the strike of the put) while still allowing for more share price appreciation (up to the strike of the call).

Closing Thoughts

There are a million ways to hedge a portfolio or single position. There are really no clear answers, as you can tell from this lengthy post. A lot of options trading is setting up different positions and weighing the pros/cons of each. Trading decisions are also going to differ depending on your portfolio and your outlook for the market.

I put on risk-reducing positions when a position I have is profitable. I don’t put on new positions and then immediately hedge them. The goal for me is to protect big profits, not initial trade capital.

Lastly, the best time to hedge is when you do not need the hedge. If you try to hedge your portfolio when the market starts falling or a position moves against you, you’re going to pay up for it.

It’s like owning a home without insurance and trying to buy fire insurance while your house is burning down.

If you try to buy fire insurance while your house is burning down, you’re going to pay the entire value of your home for the insurance.

If you buy fire insurance before a fire starts, you’ll pay a small premium for the insurance that will make the policy worth it.

Whoa, this was a fantastic and detailed publication. I was blown away by the content. Amazing, thank you!

Thanks for a detailed look behind the curtain. Good flow with very helpful visuals.