How to Make Investment Decisions w/ Opportunity Cost

When you choose one opportunity, you give up another. Which one is more valuable?

This post will help you understand why considering opportunity cost is so important. We’ll explore how it can help you make better long-term financial decisions.

What is Opportunity Cost?

Opportunity cost is what we give up (the cost) when choosing one opportunity over another.

Example

Choice A: Invest $100,000 in the S&P 500

Choice B: Invest $100,000 in bitcoin

Choice C: Save $100,000 to invest later

Say I have these three investment opportunities with $100,000 that I’ve saved up.

By choosing one of the opportunities, I naturally sacrifice the other two because I cannot commit to all three simultaneously.

Therefore, if I invest $100K in the S&P 500, my opportunity costs are:

Investment gains if bitcoin appreciates more than the S&P 500

If the S&P 500 appreciates 8% in a year ($108K portfolio value), but bitcoin appreciates 50% in a year, my opportunity cost is 42%.

If I had invested in BTC, my $100K would be $150K instead of $108K.

The opportunity cost of investing in the S&P 500 in this instance would be $42K.

But we can’t know for sure what the future will hold.

The ability to buy these assets at lower prices if they decline

If I choose to invest $100K in the S&P 500, I become fully invested. In doing this, I sacrifice the opportunity of deploying my idle cash into investments at more attractive valuations in the future.

If I invest $100K in SPY (S&P 500 ETF) at $450/share and it crashes to $350/share, I cannot invest $100K at $350/share because I fully invested at $450/share.

When fully invested, you sacrifice all future investment opportunities with that deployed capital unless you convert those investments back into cash.

Holding Cash

Holding cash is a powerful position. You can sit on the sidelines and wait for attractive investment opportunities. But holding cash comes with opportunity costs.

If you’re hoarding cash, your opportunity cost is the potential of growing your capital through investment.

If you’re holding $100K in cash while BTC and the S&P 500 appreciate 30% and 10%, respectively, those are your opportunity costs.

The benefit of holding cash is the ability to invest when opportunities present themselves. The risk is that you see the purchasing power of that cash stack fall dramatically relative to surging assets.

If you’re holding a big cash position right now or have a savings account yielding clost to zero percent, you can earn up to 9% APY by depositing that cash into BlockFi and holding USD-backed stablecoins.

Weighing Your Options

Since we can’t know the future, valuing opportunity costs depends on our future outcomes expectations.

One person’s decision to hold cash instead of invest may not make sense to another individual who decides to invest. It depends on your situation.

Early in 2021, I decided to get serious about buying a house. I was saving up as much cash as possible for the down payment on the home. Then I changed my mind.

Based on historical data, I concluded that it made no sense for me to save up a big pile of cash for a down payment on a home that may appreciate ~5% a year on average.

The specific opportunity cost I considered was the potential gain I could experience if I put that money into bitcoin instead. I expected that bitcoin could double from current prices over the next few years (a conservative prediction for an asset growing at 100%+ annually for the past five years).

Comparing allocating money to a home with ~5% annual upside vs. allocating money to an asset with 2x/5x/10x upside in the next ten years made the decision easy.

I believed that allocating the down payment money to bitcoin would allow me to much more easily buy a home in a few years if BTC appreciates significantly.

By investing down payment money in bitcoin, my opportunity cost was owning a home and any property appreciation from my purchase price.

By foregoing homeownership for a few years, I believed I could maximize my capital growth by investing in an asset with far more upside. This would allow me to acquire a home in the future more easily.

To me, this choice was better than spending all that money on buying a home now and potentially making it much more challenging to acquire bitcoin in the future. Specifically, the quantity of bitcoin $1,000 can acquire now vs. in the future.

Hypothetical Numbers

Choice A: Buy a $250,000 home with a 20% down payment ($50K investment)

Choice B: Buy $50,000 of bitcoin

If the house appreciates at 5% a year for the next five years, the home value would be $320,000.

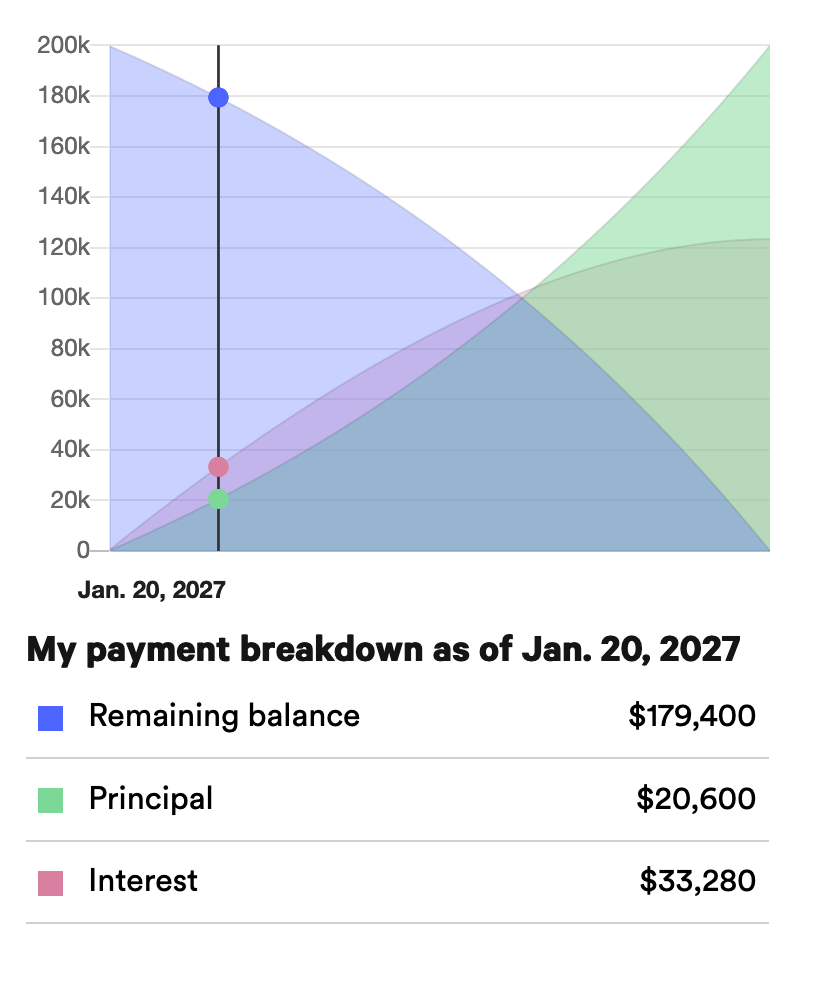

According to Bankrate, I’d pay $33,000 in interest and an additional $20,000 in principal (buying more equity in the home). These two figures make up the mortgage payments.

$50,000 initial investment + $20,000 principal payments + $33,000 interest expense = $103,000 total spend.

The initial $50,000 investment isn’t the only cost of buying a home. I need to continue to buy into the home (principal payments) and pay interest via mortgage payments. These monthly payments increase my total investment over time.

Net Profit:

$320,000 home sale price - $180,000 remaining mortgage balance = $140,000 cash remaining - $103,000 total spend = $37,000 pretax profit

If the home appreciates at 10% a year (an optimistic forecast) then the home sale price would be $400,000 after five years:

$400,000 home sale price - $180,000 mortgage - $103,000 total spend = $117,000 pretax profit.

There are tons of variables that go into real estate investment profitability. The above calculations are simple estimates based on a mortgage calculator and do not factor in region-specific insurance costs/property taxes/fees.

The benefit of buying a home is that serves as an investment and shelter. The monthly mortgage payments consist of principal (increasing my percentage ownership of the home) and interest expense.

Renting a place is pure cash burn since you don’t own the property.

If I buy BTC instead of a home, 100% of my monthly housing payments will be burned as rent expense.

To make a fair comparison, I’ll include rent expenses over the 5 years to reduce the BTC returns because purchasing BTC instead of a home means I’ll need to pay rent.

Invest in Bitcoin

I wouldn’t pay a single dollar in fees/interest payments when buying BTC, though I would pay rent because I’m foregoing a home purchase with the $50K.

$1,500/month x 60 months = $90,000 rent expenses.

If BTC remains the same over the 5-year period, I’ll make $0 on the BTC investment and burn $90,000 on rent expenses.

In the home-buying scenario, if the home price is the same after the 5-year period, I’ll burn $33,000 in mortgage interest. In that scenario, buying the home generates the more favorable financial outcome of a 63% smaller loss.

If bitcoin appreciates at 30% a year (a massive cut from its historical 110% 5-year annualized returns) over the next 5 years, my $50K BTC investment would grow to $185,000.

$43,000 BTC price x 30% annualized gain x 5 years = $160,000 ending BTC price.

$50,000 BTC investment x 30% annualized gain x 5 years = $185,000 BTC portfolio value.

If BTC goes from a 110% 5-year annualized return rate to a 30% 5-year annualized return rate:

$185,000 BTC position value - $50,000 initial investment - $90,000 rent expenses = $45,000 pretax profit.

With these numbers in mind, using a $50K down payment to buy a $250K home that appreciates at 5% annually and investing in BTC result in similar financial outcomes.

The reason a 30% annual BTC appreciation vs. a 5% annual home appreciation results in similar figures is that buying a $250K home with a 20% down payment gives me 5:1 leverage, amplifying my returns over the rate of return on the home.

So we are comparing a 5:1 leveraged (20% equity) investment to a 100% equity investment (buying BTC with no leverage).

But $160K per BTC isn’t the ceiling, especially over a 5-year time period. What if BTC goes to $250K?

BTC to $250K

($250,000 future price / $43,000 current price) ^ (1/5) - 1 = +42% 5-year annualized return.

$50,000 invested x 1.42 ^ 5 = $288,000 ending BTC position value.

$288,000 BTC position value - $50,000 initial investment - $90,000 rent expenses = $148,000 pretax profit.

BTC to $500K

($500,000 future price / $43,000 current price) ^ (1/5) - 1 = +58% 5-year annualized return.

$50,000 invested x 1.58 ^ 5 = $492,000 ending BTC position value.

$492,000 BTC position value - $50,000 initial investment - $90,000 rent expenses = $352,000 pretax profit.

To generate $352K in pretax profits on the home purchase, the $250K home needs to appreciate to $635K in five years, a 20.5% annual rate of return.

BTC to $500K: Wishful Thinking?

Bitcoin going to $500K may seem like wishful thinking because that per-BTC price seems insane. Here’s a helpful comparison: if AAPL had 19 million shares outstanding, each share would be worth $140,000.

The overall market value of BTC is a more informative metric because we can then compare it to other asset classes.

The market cap/value of gold is around $9 trillion.

Bitcoin is often called “digital gold” because it has many of the money properties that gold has, except bitcoin excels in many of these properties (more scarce, more divisible, more portable, more verifiable).

A $9 trillion bitcoin market cap would mean each of the 19 million coins in circulation would be worth $475,000. ($9,000,000,000,000 / 19,000,000 coins)

But as a long-term store of value asset (which is how many see bitcoin right now), it could take market share from any asset class that’s used as a long-term store of value: stocks, bonds, real estate, fine art, precious metals.

It’s my own belief that bitcoin will one day exceed $500,000 per coin, though the road there will be bumpy. No asset can go from worthless to trillions in market cap without high volatility.

Leverage Differences

In the real estate vs. bitcoin example, buying a home gets a big return boost from being a leveraged position (buying a $250K asset with a $50K down payment = 5:1 leverage).

Read: Leverage 101: The Basics of Borrowing Money to Buy Assets

The BTC investment scenarios involve zero leverage. At $43,000/BTC, a $50,000 investment buys 1.16 bitcoin.

If I introduce 2:1 leverage, I can acquire 2.32 BTC:

$50,000 in equity + $50,000 in debt = $100,000 investable capital

$100,000 capital / $43,000 per BTC = 2.32 BTC

In the first scenario where BTC ends at $160,000/BTC, 2.32 BTC would be worth $371,000. After paying off the $50,000 debt and accounting for $90,000 in rent expenses over 5 years, I’d be left with $231,000 in cash (before taxes). I’d pay $13,000 in loan interest as well at 10% interest on the $50K loan. A far superior outcome to buying the home, even with 10% annualized home price gains.

As we’ve discussed, one person’s decision to buy a home instead of BTC wouldn’t make sense to another investor who believes BTC will appreciate substantially over the coming 5-10 years.

Conversely, an investor who doesn’t believe in BTC will opt to buy the home instead of BTC.

And, investors in lower risk tolerances will prefer the lower probability of real estate prices collapsing compared to bitcoin falling 50% (a fairly routine drawdown).

Final Thoughts

Based on the numbers, there are certain scenarios where buying a home turns out to be a better financial decision than buying BTC. And there are scenarios where buying the S&P 500 would be better than buying a home or BTC. There are scenarios where holding cash would be the superior choice.

With that said, there’s virtually no chance that the home I buy appreciates at 30% annually for 5 years (unless there’s hyperinflation, in which case the per-dollar price of everything surges as the USD, the denominator, collapses).

But there is a chance that BTC appreciates at that rate or more.

It really came down to this consideration for me: which asset do I believe will be harder to acquire in 5-10 years’ time? A nice home or one bitcoin? An ounce of gold or one bitcoin?

My belief was/is that BTC will get much harder to acquire and that drove my decision to forego buying a home in 2021. I could be wrong. But based on my beliefs, the opportunity cost of buying a home instead of BTC is too large. Your beliefs could be the opposite. That’s what makes a market.

Assessing Investment Opportunity Costs

The specific assets/positions we’re comparing don’t really matter.

The point is to compare various possible outcomes of each financial decision and choose the one that you believe will generate the greatest financial outcome.

I hope you enjoyed this post. Let me know if you have any questions!

Enjoy your weekend.

-Chris

Dude you rock , keep going .

You should put that $100k (theoretically) into an Interactive Brokers Pro account. Their margin rates are very good... like around 1.5% for that amount of a deposit. You can use leverage up to 2:1 for overnight borrowing and buy BTC right on their platform. Problem is if BTC goes down more than 50% you'll get margin called, so I would borrow closer to 1.5:1 to be safe!