Investing is never an easy game.

Unfortunately, it’s gotten even harder.

Typically, there’s an array of potential investments to make, ranging from:

Low-risk, low-reward

High-risk, high-reward

Positions like cash, savings accounts, CDs, and U.S. Treasury bonds fall in the lower-risk camp.

And positions like stocks, commodities, real estate, and crypto-assets fall in the higher-risk category.

No matter where you put your money, you can't hide from risk, and traditional "low risk, low reward" assets provide little/no return and can ironically be viewed as liabilities instead of assets.

💵 Cash/Savings 💵

Historically, cash is the one position guaranteed to lose value over long periods.

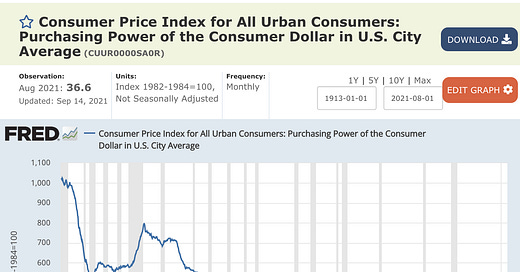

Because of inflation, the purchasing power of cash decays over time. Here’s a long-term chart of the U.S. dollar’s purchasing power (the value of $1 vs. rising prices AKA inflation):

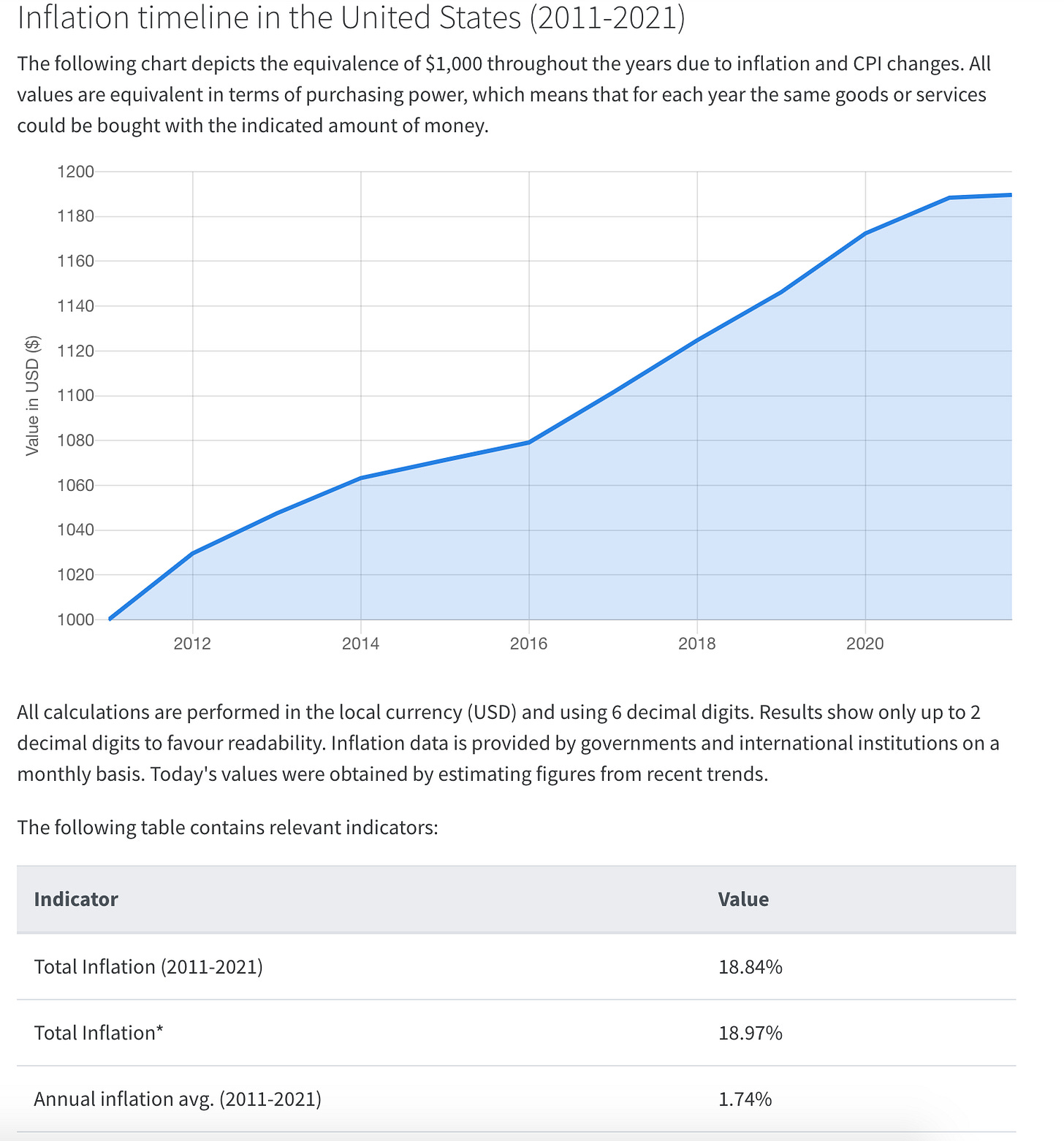

Loss of purchasing power is sneaky. If you had $1,000 in your bank in 2011 and have $1,000 in your bank today, it seems like you didn't lose anything.

You did.

Today, you need $1,200 in your bank to have the same purchasing power as $1,000 in 2011 (based on CPI):

Savings accounts are earning close to zero today:

Inflation is running much hotter than the typical 2% target:

It's always wise to save enough cash to pay for monthly expenses, emergencies, and future investments.

Outside of that, cash is a long-term liability since it will lose purchasing power over time and doesn't provide any upside.

That sounds crazy because cash is an asset, at least on a company’s balance sheet. And in the short-term it is. Cash is safety. Cash is the opportunity to invest more in a downturn.

But cash also has exposure to complete loss in the worst-case scenario of hyperinflation.

In a hyperinflation event, people lose faith in the currency and stop accepting it as payment, or request more units of it for goods/services.

Anything can be currency if a group of people believes it has value. As soon as that changes, the currency fails. Simple as that.

So keeping 100% of one’s wealth in cash is not a safe position because it will lose value rapidly in the event of hyperinflation.

The low- and middle-class are hit hardest by inflation because they own fewer hard assets than the upper-class.

🤝 Bonds 🤝

U.S. Treasury Bonds aren't much better.

10-Yr Treasury Yield = 1.51%

30-Yr Treasury Yield = 2.05%

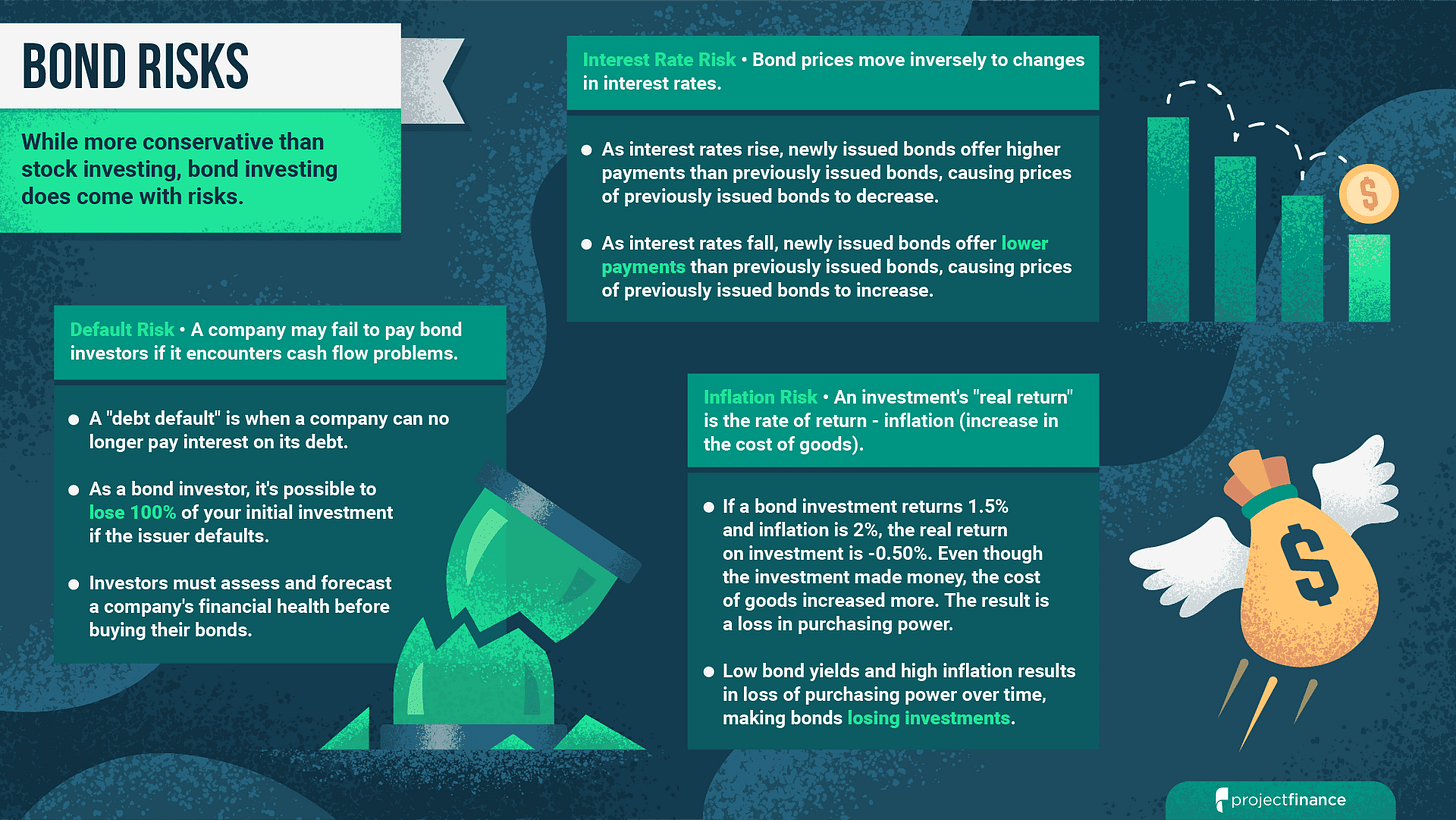

While better than earning 0% on cash, bonds come with risks:

The borrower may fail to pay you back (default risk)—risk of a complete loss.

If the cost of things rises more than a bond's yield (inflation > yield), the real return on investment is negative.

If interest rates rise, bond prices fall, leaving investors with unrealized losses on their bond positions.

Buying bonds right now isn’t very attractive because yields are low, talks of rate hikes are present, and current + future inflation expectations are high.

That gives the above bonds virtually reward-free risk.

Lastly, bonds are currency-based contracts, which means all currency risks transfer over to bonds. In other words, bonds are destroyed in currency crises because bonds are currency-based contracts (bond interest payments and principal are paid in local currency).

📈 Stocks 📈

Since cash/savings/bonds aren't providing returns, investors must buy higher-risk assets like stocks to have a chance at growth.

The S&P 500 is near all-time highs, up 20% this year.

The Shiller P/E (CAPE) ratio is currently around 38, indicating rich U.S. stock valuations.

The more you pay for something, the lower the potential return can be going forward.

Lyn Alden featured a chart in her CAPE ratio blog post showing CAPE ratio vs. forward stock market returns:

A higher CAPE ratio points to lower future returns. Of course, past != future.

So we can hold cash/savings/bonds and likely lose purchasing power over time or buy stock indices at rich valuations and have questionable future returns with substantial downside risk.

🟡 Gold 🟡

Gold is considered an asset that protects against inflation.

Despite high inflation numbers and growing worries about future inflation, gold has been negative in recent history.

Some argue it’s because bitcoin is the “digital gold,” having the sound money characteristics of gold, except better on many levels (more divisible, transportable, verifiable, secure).

Gold’s track record beats bitcoin, as bitcoin is only 12 years old and gold has been around for thousands of years.

🏡 Real Estate 🏡

The combination of cheap debt, demand for hard assets, and low supply have helped real estate prices surge.

Like stocks, do we buy in at recently inflated prices to chase returns, even though expected returns are lower?

Borrowing to buy hard assets like real estate is a strategic move right now for those that can afford it/are in the market for a home.

The benefit of using debt to buy real estate in a high inflation environment is that inflation benefits borrowers.

The dollars used to pay off the debt in the future aren't as valuable as dollars today, especially if inflation is high.

Extreme example: a person borrows $500,000 today to buy a home.

Hyperinflation occurs, and now loaves of bread are worth $500,000 (this means the currency is basically worthless).

Take a loaf of bread out of your pantry and sell it for $500,000. Pay off mortgage. Free house.

I’m not saying that will happen here or soon, but that’s how inflation vs. debt works.

⛓ Crypto ⛓

We arrive at crypto, the newest asset class on the block.

Many compare crypto today to the dot-com era. Thousands of new assets pop up, hoping to be the next big thing.

Many will be worth zero, and some will be worth trillions.

Global wealth is in the hundreds of trillions and crypto is worth about $2 trillion.

The image below is from May 2020 and doesn't feature current market valuations, but provides context nonetheless.

While crypto comes with the potential for total loss in many cases, the upside potential is massive.

Bitcoin's market cap is <$1 trillion, and gold's market cap is approx. $10 trillion. Many predict Bitcoin will eventually overtake gold as it is the "digital gold."

A $10 trillion market cap puts each bitcoin at around $500,000, more than 10x from current prices.

What's the probability? Who knows. If the probabilities of overtaking gold or going to zero are 10% and 90%, the expected value of BTC is $50,000, higher than it is now.

The only variable in bitcoin is demand. Supply is completely predictable. I can tell you how many new bitcoins are created each day (900), increasing bitcoin’s supply by about 1.8% annually.

I can tell you that in September of 2026, about 450 new bitcoins will come into circulation each day.

All 21,000,000 coins will exist around the year 2140.

With fixed/predictable supply schedule, the only question is “what will demand do?”

It’s increasing.

A growing list of public companies are buying and holding bitcoin, institutions are rushing to offer bitcoin to their clients, countries are adopting it as currency, millions are using the Lightning Network to pay for coffee in El Salvador, bitcoin ETFs are coming, and Twitter just enabled user-to-user bitcoin payments via the Lightning Network.

Regardless of your crypto beliefs, the point is that the asset class is here to stay and has massive upside potential, deserving attention from investors.

🔚 Conclusion 🔚

In 2021, traditional "low-risk" positions do not provide returns above inflation, pushing investors into riskier asset classes.

Consequently, the prices of these assets have risen quickly recently, lowering future expected returns from here.

Investments involve risk, reward, and probabilities.

Cash/savings/bonds have risk with a high probability of no/negative reward.

Stocks have significant downside exposure with an arguably high probability of low reward potential from current levels. Of course, the run can continue!

Real estate prices have also risen quickly, again reducing expected returns in the future.

But for those that can afford to, taking out debt to buy a hard asset like RE *can* be a strategic play in a high inflation environment because inflation benefits borrowers.

As a young asset class, crypto offers high-risk investors the potential of exponential upside returns coupled with the potential of 100% loss.

The specific mix investors choose depends on risk tolerance/age/wealth.

Unfortunately, the classic "low risk, low return" assets have low/no reward and high risk for conservative investors.

You could even say cash/savings/bonds aren't assets but liabilities, as liabilities extract value from you over time.

Investment predictions aren’t super helpful, and I don't have clear advice here.

The takeaway is that the investment landscape is challenging, particularly for older investors/retirees with a wealth preservation focus.

A balanced portfolio with exposure to many assets is safest because it removes a single point of failure.

I have an accumulation strategy as I am a younger investor. I am not actively trading in and out of long-term investment positions. The only trading I’m doing is with my option positions. Even those positions are longer-term in nature.

I believe that people will do well by purchasing hard assets and holding long-term, but certain asset classes are a lot more attractive in terms of risk/reward.

For a 10+ year holding period, I see bitcoin as one of the best asymmetric return opportunities with favorable probabilities based on the momentum of adoption.

Fixed/predictable supply + increasing demand = “number go up.”

I either lose 1x or multiply it many times over. 100x is possible over 10+ years. I won't get that in stocks/bonds/RE/gold.

The goal of this post was to hopefully surface ideas that maybe you haven’t thought of yet.

I can’t tell you what to do with your money as investing is personal, but I hope I’ve provided some insights here that you can use to your benefit.

What are your thoughts after reading this? Also, let me know if you like this type of stuff or what you’d like more content on.

-Chris