The Best Bull Market Options Strategy?

Learn a powerful options strategy capable of delivering huge returns during a bull market run.

Hey traders,

One of the biggest benefits of options vs. buying stocks is the magnification of gains we can experience when we buy options and are correct about the stock price direction.

For instance, when a stock goes up 10%, certain call options on that stock will go up many multiples of 10%. Some calls will go up 30%. Some calls might go up 100%.

But many traders gamble by purchasing short-term options that go to zero overnight if they aren't right about the stock making a huge short-term movement.

Buying LEAPS

Options with expiration dates further than a year out are referred to as LEAPS, which is short for "Long-Term Equity Anticipation Securities."

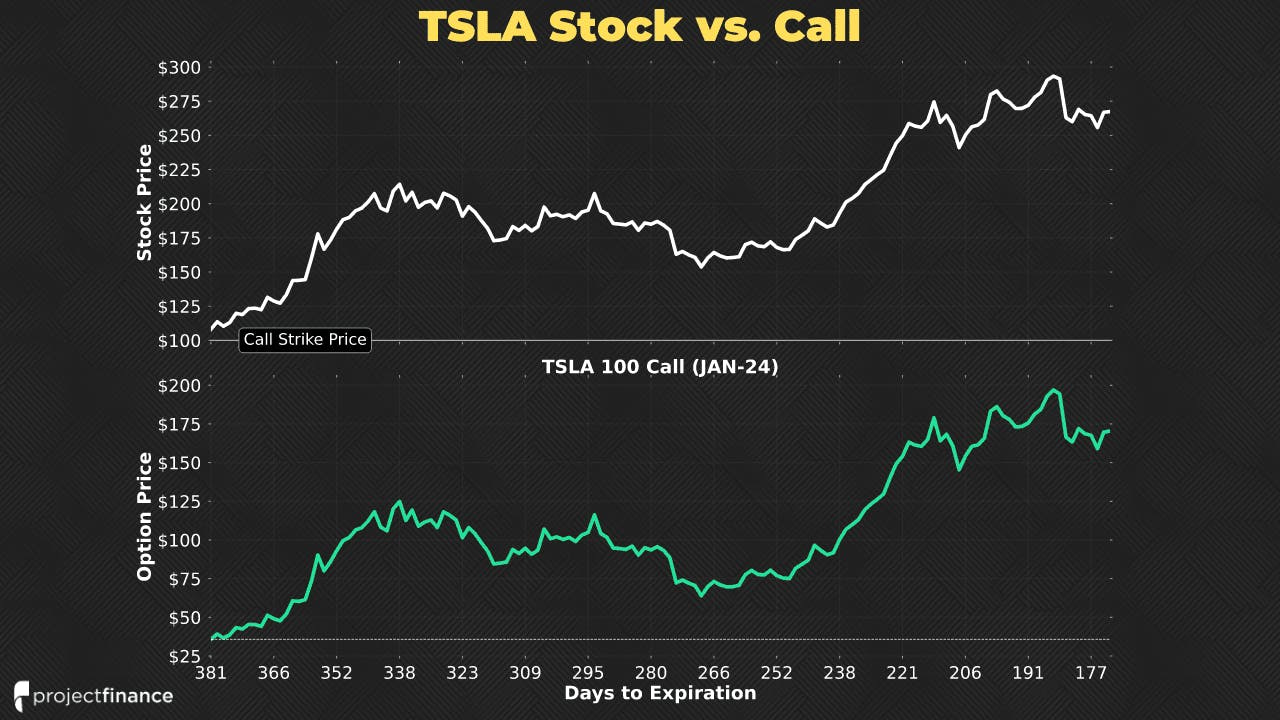

Here's an example in TSLA of how buying call LEAPS (long-term calls) can lead to a multiplication of returns relative to the stock price:

The stock price goes from around $110 to $275 at the end of the period (first 6 months or so of 2023).

The 100-strike call expiring in January 2024 went from $35 to $175 during the same period.

So the stock price went up 155%, while the call option went up 400%.

Of course, this is a huge stock return in a short period of time, and any investor would be happy with a 155% return in shares of stock they own. The point of the example is to demonstrate the power of buying long-term options to potentially amplify returns relative to stock when a trader has a strong directional prediction for a company's stock.

Timing Matters

Just like with any options strategy, timing matters. Let's look at buying a TSLA call on February 15th, 2023, right before TSLA began its slide as shown in the above graph.

The stock price fell from $215 to $153 in the first couple of months in the trade, a decline of about 30%.

The June 2024 200 call went from $60 to $17 over the same period, a decline of about 70%.

From beginning to end, the stock price has appreciated 25%, while the call has appreciated 30%. So the long-term call has much higher volatility than the shares of stock.

The call still has 326 days to expiration as of the above image, so there's plenty of time for TSLA to make a big run and drive substantial gains in the call option.

The point is, if you have strong conviction in a company and believe their stock price will rise substantially over the coming 1-2 years, buying long-term call options can deliver superior returns to the stock, especially if you buy into a decline/before a big bull run.

The "Hypergrowth" strategy outlined in Data-Driven Options Strategies is based on purchasing long-term call options on equity indices and individual stocks.

Which Strike to Buy?

There are many calls/puts to buy when looking to get long-term exposure to a big stock price movement. Which strike is best?

AMZN's share price is $138 in the above image.

Any strike below $138 is in-the-money (ITM). Any strike above $138 is out-of-the-money (OTM).

Personally, I like to choose strikes that are anywhere between slightly in-the-money and out-of-the-money.

In this example, that would mean somewhere between $120 and $150.

The further ITM strikes cost more, but have more intrinsic value in their prices, which means less exposure to time decay and changes in IV. They also have lower breakeven prices, requiring smaller stock price increases in order to break even at expiration.

The further OTM strikes are cheaper and are 100% extrinsic value, meaning more exposure to time decay and changes in IV. They have higher breakeven prices, requiring larger stock price increases in order to break even at expiration.

Given the same short-term stock price increase, the ITM options will deliver smaller returns compared to the OTM options. For instance, if AMZN went from $138 to $145 tomorrow, the ITM options would deliver smaller returns than the OTM options.

If AMZN collapses, the ITM options have more value to lose than the OTM options. So there are pros/cons to each approach.

The main balancing act is between the conviction in the stock price movement and how much money you want/can allocate to the strategy.

For stronger bullish convictions, further OTM strikes can work well. For bullish convictions that aren't as strong, ITM strikes are safer as they have lower expiration breakeven prices.

Risks Involved

While buying long-term calls can deliver huge returns relative to the stock, buying calls does have a time limit and can lead to 100% loss of capital if the stock price is below the strike at expiration. An investment in shares only delivers a 100% loss if the stock goes to zero.

Fortunately, 1-2 year options have a lot of time for directional predictions to play out. If I buy a 900-day call in AMZN, I get 2+ years of time for my bullish prediction to pan out. And since earnings happen every 90 days, I get exposure to 10 earnings reports, which can be strong catalysts for stock price movements (positive or negative).

It is important to be mindful of the risk of loss and not forget about buying stocks as long-term investments. If I don't have a strong bullish 1-2 year outlook on a stock, I would rather own shares instead of long-term calls.

Implied Volatility

A decrease in implied volatility means option prices have deflated as market participants forecast lower levels of stock volatility going forward. If I buy an option and IV collapses, I'll lose money on my position as option prices deflate from the now lower expected stock volatility.

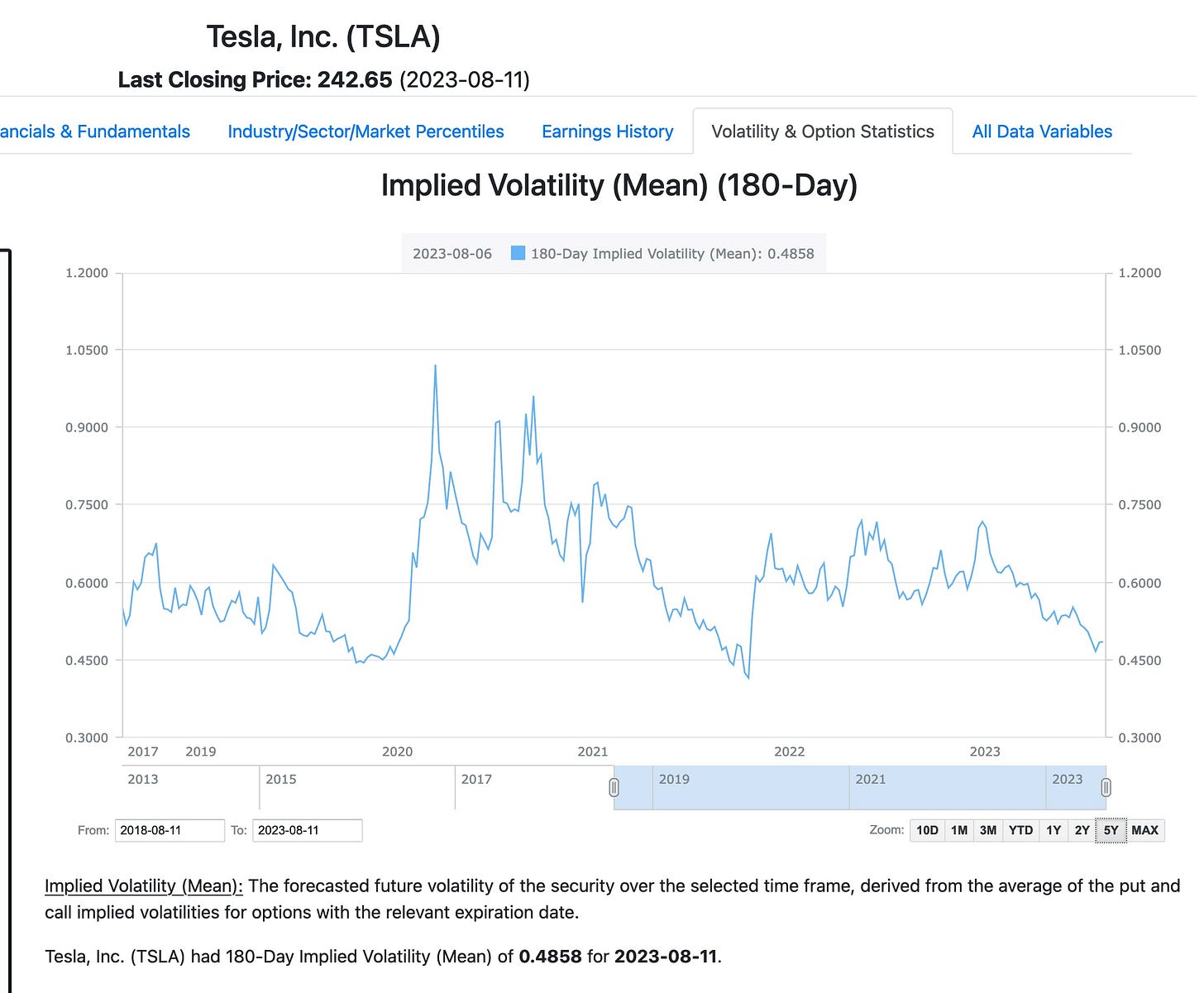

Therefore, it's a good idea to check what the long-term IV level is and what the trend has been. I use AlphaQuery for this purpose as they provide IV metrics for various time frames other than 30 days:

The above graph shows implied volatility derived from ~180-day TSLA options, the longest-term IV they provide.

The current reading is at the bottom end of the range, which makes me more comfortable when considering buying long-term TSLA options. If the IV trend was surging (as it did in 2020-2021), I would be more hesitant to purchase options as a deflation of option prices could lead to losses on the position even if the stock price moved in my favor.

Have any thoughts/questions regarding this strategy? Let me know!

Cheers,

Chris

Founder, projectfinance

P.S. Stay tuned for more exclusive content and valuable insights to boost your options know-how.