How to Buy Bitcoin Like Warren Buffett

Warren Buffett hates Bitcoin, but we can still apply his investing strategy to the asset.

It’s no secret that Warren Buffett hates bitcoin.

He’s famously referred to it as “rat poison squared.”

“I don't have any Bitcoin. I don't own any cryptocurrency, I never will.” - Warren Buffett

But Warren is 91 years old. It’s completely understandable that he doesn’t “get” an asset that is based on the most new-age technology.

I believe Warren is dead wrong on this one.

I’ve been making options trading/finance videos for five years now, and I haven’t once made hard suggestions or recommendations as to what people should do with their money, until now.

I’m willing to stick my neck out on this one and say that not having exposure to bitcoin will be one of the greatest financial mistakes of this century.

Of course, I have to disclaim that it could fail. Nothing is guaranteed. But the risk/reward (lose 1x, potentially make 100x+) is a no-brainer compared to all of the other investment opportunities.

At this point, I believe bitcoin is too deeply entrenched in the global financial system to fail entirely.

U.S. Regulators Exploring How Banks Could Hold Crypto Assets

Just yesterday, an article from Reuters stated that U.S. regulators are looking to work towards crypto ownership on bank balance sheets.

By “crypto,” they most likely mean Bitcoin and not dog-based coins such as Doge or Shiba-Inu.

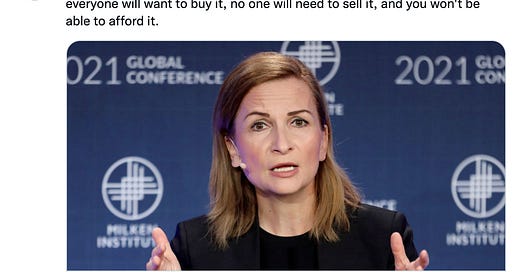

"I think that we need to allow banks in this space, while appropriately managing and mitigating risk," - Jelena McWilliams, Chairwoman of the Federal Deposit Insurance Corporation (FDIC)

With several Bitcoin-linked ETFs recently approved by the SEC and launched into the markets, and the FDIC chairwoman opening the discussion as to how banks can offer crypto to their clients, a government ban of bitcoin is pretty much off the table.

How I Buy Bitcoin

I’ve been asked many times how I buy bitcoin.

Firstly, I strongly oppose buying bitcoin-linked ETFs/products like the ProShares futures-based ETF (BITO), or the Grayscale Bitcoin Trust (GBTC).

Owning a stock certificate that tracks the value of bitcoin is not the same as owning the asset yourself. Owning GLD is not the same as owning a bar of gold. You can’t use your GLD shares, but you can use physical gold if you needed to.

The point of bitcoin is to remove third parties from your money, and if you invest in an ETF, you do not truly own bitcoin.

My preferred platform for buying BTC is Swan Bitcoin for automatic, recurring purchases. I buy every day without thinking about it.

The link here is an affiliate link that will get you a $10 signup bonus and the “Inventing Bitcoin” eBook that does a great job of explaining everything you need to know about it. If you’ve benefited from my free work in the past, using the above link would be a great way to say thank you.

I bought every day through the summer, which is a Warren Buffett style strategy that performed very well given the volatility that allowed me to “dollar-cost average” into the asset:

If you aren’t familiar, “sats” refers to “satoshis,” which is the smallest denomination of a bitcoin.

Like $1 USD is equal to 100 pennies, 1.0 bitcoin is equal to 100,000,000 satoshis or “sats.”

You don’t need to buy one whole bitcoin for $60,000. You can invest a few dollars if you’d like.

Compared to low dollar purchases on a platform like Coinbase, Swan has much lower fees:

But if you are going to make a large, lump-sum purchase, then using a platform like Coinbase Pro is preferable because the fee will be lower than Swan.

The last benefits of Swan are that they emphasize education, and your BTC is held in “cold storage” (offline) at Prime Trust in your name, which is very different from having your BTC in a “hot wallet” (hackable) on an exchange like Coinbase.

Investing for Your Children

If you have children that you are saving/investing for, then I believe putting some money away frequently into bitcoin is a phenomenal strategy given the long-term time frame you have.

If you have 10+ years of investing for your children’s college expenses, bitcoin is a great option given the potential for price increases over the long term.

And compared to the alternatives of cash/savings/bonds that have negative purchasing power returns right now and richly-valued stocks, I believe an allocation to BTC is an intelligent financial decision.

Assessing the Investment Opportunity

Bitcoin is a $1 trillion asset in a world of $100s of trillions of global assets.

Gold is a $10 trillion asset that has lost value this year, a time when inflation is high and fears of higher inflation are present. Bitcoin is the digital gold and has increased over 100% this year.

Surpassing the market cap of gold would put each bitcoin at ~$500,000.

The global stock market is around $100 trillion in value, and bonds/debt are over $100 trillion.

There’s $15+ trillion in negative-yielding debt, meaning bondholders are paying to park their money in those bonds with ZERO upside potential. Guaranteed loss of purchasing power with the risk of a hyperinflationary event wiping out their investment.

Overall, there’s a sea of money that bitcoin will consume a portion of when people wake up to the realization that traditional assets have poor risk/reward (or reward-free risk as described above).

Do Your Own Homework

I know it can be a big red flag when someone speaks of an investment opportunity with conviction and optimism. As I said, I’ve been making options videos for five years and have avoided making any specific recommendations 99% of the time. I want people to use the information on my channel as they see fit.

But for the past 18 months, I’ve been learning and thinking about Bitcoin and the state of the asset markets. Nothing makes as much sense to me as bitcoin does, and I’m willing to stick my neck out and say that not having bitcoin exposure will be a colossal financial mistake.

I’m writing these newsletters because I genuinely believe this is a phenomenal financial opportunity. We, as the little guys, have the opportunity to front-run an asset before large financial institutions, rich people, and countries get involved. The opposite is generally true in the traditional asset markets.

In the end, it’s your decision, but I believe the more time you spend learning about this, the more it will make sense to you.

“Anyone who studies Bitcoin ends up investing in it.” - Anthony Scaramucci

Bitcoin is a highly volatile asset right now, and new investors should expect to see wild fluctuations in their investment in the short term. I’ve been buying since 2020 and haven’t sold a single satoshi. I’m in it for the long haul.

Over the long-term, it’s not unreasonable to see Bitcoin at $500,000 per coin as it overtakes gold as a store of value, and eventually millions per coin as more companies, financial institutions, and countries allocate money to it.

So if you think you “missed it,” you didn’t. It’s still very early. A $1 trillion asset with an addressable market of $100s of trillions and rapidly increasing demand. 21,000,000 coins.

If I’m completely wrong and you have a few percentage points of allocation, then you’ll lose a few percentage points of your portfolio. If I’m right, even a 5% allocation could drive a 500% portfolio return over the long haul. Those numbers don’t exist in stocks or real estate. And in cash/savings/bonds, you’re guaranteed to lose a few percentage points of purchasing power on an annual basis as of now (inflation > returns on cash/savings accounts/bonds).

It’s only risk/reward analysis. Nothing more.

I’ll leave you alone with these ideas, but if you’re interested, check out Swan Bitcoin to see what they’re all about, and easily set up a recurring purchase plan with their low fee platform. It’s the easiest, safest, and low-cost way to “get off zero.”

Please refer to the below resources for learning about Bitcoin and its value proposition:

The Bullish Case for Bitcoin - a concise read on the opportunity of bitcoin. The FIRST resource I send everybody curious about BTC.

The Ultimate Argument for Bitcoin - a podcast with Anthony Pompliano (Pomp) and Murad Mahmudov.

The Bitcoin Standard - a more in-depth read on the history of currencies, what money represents, how bitcoin works, and more.

The Price of Tomorrow - not about bitcoin specifically. Explores the world of inflationary monetary policy vs. deflationary technology, and why our debt-fueled economies are unsustainable. Fascinating read.

But how does bitcoin actually work? - Animated YouTube explanation.

Philosophy of Bitcoin From First Principles - a fascinating 4-hour podcast with Lex Fridman and Robert Breedlove. This conversation will absolutely blow your mind, and I could not recommend it more.

The Saylor Series - a podcast series with Robert Breedlove and Michael Saylor (CEO of MicroStrategy) about bitcoin, but it’s also much more than bitcoin. It’s about how humans have advanced through the ages by harnessing energy more efficiently and why energy money makes sense. It will take you a while to get through all 13 episodes (current series length). The series was a game-changer for me.

Bitcoin Net Zero - a recent paper by Nic Carter and NYDIG on how bitcoin is saving people in the harshest economic environments around the world and why bitcoin’s energy consumption is not a problem.

This Machine Greens - A new 30-minute documentary discussing bitcoin’s energy consumption and how it is changing the world of energy for the better.

Storing Bitcoin - a guide on storing bitcoin (or any crypto) securely. If you invest a considerable sum of money into any cryptocurrency, I would highly recommend “cold storage” / self-custody where you cannot get hacked. If you hold crypto in a “hot wallet” such as buying and holding on Coinbase, your funds are lost forever if they get hacked and your crypto is stolen.

And my older newsletter regarding buying bitcoin.

Thank you for reading! Please let me know if you have any questions by commenting on this post. I’ll provide my best answers to your questions ASAP.

-Chris

One of the best written articles on Bitcoin I've seen so far. Great job, Chris.

Buffet likes commercial banks such as Wells Fargo and BofA or BAC, because they have the ability to create dollars out of thin air via fractional reserves. Bitcoin, OTOH, while it is expanding at the moment, will be fixed at 21,000,000 making owning bitcoin, for THEM, a purely speculative move; not something in which banks should be involved. It was the banking industry and powerful bankers that pushed for nations to go away from the gold standard to FIAT currencies at the beginning of the 20th century and the perpetual inflation that relentlessly erodes purchasing power and is the cruelest, most regressive tax of all.

Bitcoin will be the way to avoid much of that. Dollar cost averaging, as practiced by you, is the best way to accumulate bitcoin at the best price over the long term.

There is, however, ONE thing that worries me, perhaps unnecessiraily: In 1933 Frank D. Roosevelt OUTLAWED the private ownership of gold, the 'approximate' basis for the value of the U.S. Dollar and most currencies around the world. What is to prevent some future fascist government from doing exactly the same thing with Bitcoin by either fiat or international treaty?