Why Everyone Should Consider Buying Bitcoin (Front-Run Institutions & Countries)

Why everyone should learn about bitcoin and consider buying BTC. You are EARLY.

Good morning all! I hope everyone had a great weekend! I can’t believe it’s already October. Let’s hope October is friendly to us in the markets!

This is a post about bitcoin. My bitcoin videos on the YouTube channel have sparked more negative comments and a higher percentage of downvotes compared to all videos on my channel.

Some of you may hate crypto/bitcoin and may unsubscribe from this very newsletter because I’m bringing it up, but that’s ok. I’m doing it because I genuinely care. I don’t want to keep my audience in the dark about what I think is one of the greatest wealth creation opportunities on the board right now.

If you’ve been trading options for a decent amount of time, you know that all trades have risk, reward, and a probability of success. I see bitcoin as the trade with the greatest amount of reward relative to the risk, and a favorable probability of success.

I don’t want to be in a future scenario where I only talked about options trading on my channel but had the most life-changing financial gains from something else that I was keeping in the dark.

For the past five years, I’ve been creating content about options trading.

As everyone does, I evolved over time. My options trading and investing philosophies changed.

My interests also changed.

In April of 2020, I was out with a friend, and I asked him: “which three books should I read RIGHT now?”

His reply:

“The Bitcoin Standard, The Price of Tomorrow, and Aftermath.”

I read the first two, which I highly recommend. Your mind will most likely be blown. At the very least, you’ll come out the other side a much smarter human being.

You can’t lose.

Within the first few pages of The Bitcoin Standard, I started laughing to myself on my couch because it became so obvious to me.

It was a lightbulb moment. I knew from that moment that a lot of my time and energy would go into learning about and buying bitcoin. I saw it as the highest priority position to build and still do.

Since going down the rabbit hole over the past year and a half, I’ve grown more and more bullish on bitcoin as a key piece of the financial system in the future and also as an investment from current levels.

Overall, bitcoin is about more than making money. It’s about equality. It’s about allowing everyone in the world to store value across time without seeing purchasing power inflated away from the decisions of small groups that occur behind closed doors.

It’s about being able to send value across borders, almost instantly, without permission from anyone.

The road to that future involves a wealth creation opportunity.

As I highlighted in my recent newsletter, Investing in 2021 is Tricky, every position has risks. It doesn’t matter if you’re in cash, savings accounts, bonds, stocks, real estate, or crypto. In my opinion, significant loss potential exists in all of these positions, but crypto has the MOST upside from here in the next 10 years.

Cash/Savings/Bonds: Risk with a virtually guaranteed loss of purchasing power.

Stocks: Always the potential for 50%+ declines. Arguably low upside from here going forward given current levels and the craziness we’ve seen over the past year in many stocks.

Real Estate: Home prices have been surging, and so buying here isn’t as advantageous as buying in last year. Typically requires a lot of money to get involved, you risk losing your property if your income falls and you can no longer pay your mortgage, and RE can be expensive tax-wise. Real estate is also illiquid.

Crypto: Has been exploding, which means forward returns are lower than they were, but there’s still an insane amount of room for growth.

The cryptocurrency market cap (combined value of all cryptocurrencies) was $190 billion in January of 2020 and now stands at $2.1 trillion.

The crypto market is dominated by BTC ($890 billion) and ETH ($390 billion):

It may look ‘bubbly’ when looking at a chart of either token and seeing them 10x over the past 12 months, but it is still early.

The Global Wealth Report by Credit Suisse estimated that global wealth in 2020 totaled $418 trillion:

A $2 trillion market cap vs. $418 trillion in global wealth is a drop in the water.

Bitcoin’s value proposition is simple: provide equal access to sound money to everyone in the world. The total addressable market (TAM) is the entire world. 8 billion people. 195 countries. Everyone needs good money, and a lot of people don’t have it.

If you’re reading this and live in the U.S., know that you are privileged to live in a country with the best-performing fiat currency (USD) of the fiat currencies that exist.

The problem that bitcoin is aiming to solve isn’t as obvious here as it is in other countries, as discussed in the recent Bitcoin Net Zero paper by Nic Carter and NYDIG.

Bitcoin as an Investment

First, did you know that you don’t have to buy a whole bitcoin? Many write off bitcoin as an investment because one coin is $50,000 and that’s a lot of money.

Similar to how $1 is divisible into 100 units called pennies, one bitcoin is divisible into 100,000,000 units called satoshis (sats). Investing $1 into bitcoin will get you around 2,000 sats as of now.

Global wealth is $418 trillion. If bitcoin consumed all of the world’s wealth, that would put each coin at roughly $20,000,000.

Of course, that’s a stretch, at least in the short term.

If we use a more conservative 5%, then that’s a market cap of $20 trillion, giving each bitcoin a value of nearly $1,000,000.

At 1%, that’s $4 trillion, or $200,000 per coin.

Gold’s market cap is $10 trillion, and bitcoin is sometimes referred to as the “digital gold.” It has all of gold’s money properties, except it’s better in most categories.

Vijay Boyapati’s post, The Bullish Case for Bitcoin, included a nice table summarizing bitcoin vs. gold vs. fiat currency (like the USD).

If you haven’t read The Bullish Case for Bitcoin, I would HIGHLY recommend doing so. It’s phenomenal and won’t take too long to get through.

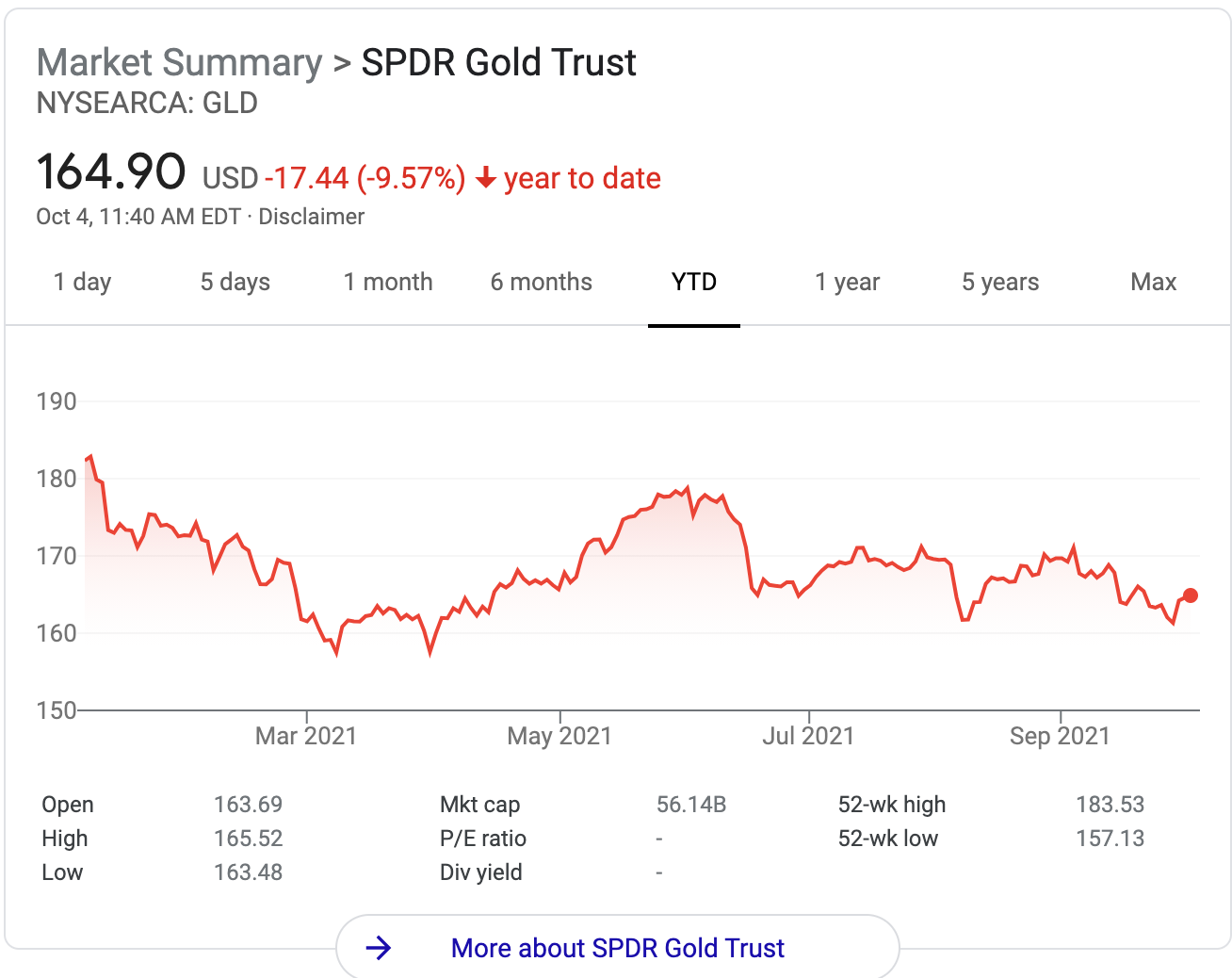

Gold is supposed to be an inflation hedge, or perform well when inflation is high/expectations are high. Both conditions are true right now, yet gold has stumbled this year:

And the 10-year returns of gold, bitcoin, and the S&P 500:

The natural question is: will bitcoin consume gold’s market cap? Is it currently doing that?

If bitcoin overtakes gold’s market cap of $10 trillion, each bitcoin will be worth around $500,000. About 10x from current levels.

That’s only gold.

There’s an estimated $16.5 trillion in negative-yielding debt. That means people are paying money to store their currency in bonds. Reward-free risk.

What if some of those funds make it into bitcoin, an asset that’s pretty much programmed to increase over the long term?

What happens when more public companies announce ownership of bitcoin on their balance sheets, replacing their decaying cash positions with an asset that can add substantial value over time?

With each new announcement, the bitcoin price will respond favorably, perhaps parabolically depending on the company announcing.

That puts pressure on other companies to do the same. The last corporation to adopt it will pay the highest price. The earliest corporation (MicroStrategy) stands to gain the most.

The same is true for countries. The first countries to adopt bitcoin stand to gain the most financially. The last countries stand to gain the least.

El Salvador is the first country to adopt bitcoin.

Many South American countries are heading in the same direction.

And as the price goes up, it will attract more attention, pulling more users in.

Additionally, bitcoin is too small for large entities to buy it without moving the market, which means as it increases in value it becomes more accessible to the largest of institutions.

There are currently 18.8 million bitcoins in circulation, and there will only ever be 21 million coins to exist.

Right now, 900 bitcoins come into the circulating supply each day.

In 2024, that number falls to 450 new bitcoins per day.

In 2028, it falls to 225 new bitcoins per day.

The issuance rate will halve every four years until all 21 million coins exist around the year 2140.

The supply limit and issuance rate are predictable:

The only thing bitcoin investors need to predict is demand.

Will more or fewer people use bitcoin in the future?

Will more or fewer institutions own bitcoin in the future?

Will more or fewer countries hold bitcoin in the future?

The bottom line:

There are 21,000,000 bitcoins for 8 billion people + all of the world’s corporations + all of the world’s countries.

Of course, there’s a non-zero chance that bitcoin fails and goes to zero.

While I believe it’s unlikely at this point, it could happen.

As bitcoin continues to survive, the likelihood of surviving increases (the Lindy Effect).

And as a monetary network, its value grows as the number of users grows. All networks get exponentially more valuable as more users join them (the Network Effect).

The point is, there’s 1x risk and 10-100x potential over the next 10 years.

No traditional assets have that risk/reward profile right now. That’s why I feel so strongly about encouraging others to do some research, at least 10+ hours (ideally 100+ hours) before writing off crypto.

I feel that there’s a body of people who have a distaste for crypto because many people have gotten rich already and newcomers feel it’s too late.

It’s not. We are still early. Being an early adopter has risks, but early adopters stand to gain the most.

Will bitcoin go up forever? Not 200% annually like it has since inception. The rate of growth will slow over time as it reaches higher levels of adoption.

One thing is for sure: wealth held in bitcoin cannot be inflated away by a central authority, making it an attractive store of value asset long-term (10+ years).

And with that, I’ll leave you with the BEST resources to learn more about bitcoin and decide for yourself if you want to add some to your portfolio.

I could write for hours about this, but there are already amazing resources that do a better job of explaining things than I can—no need to try and reinvent the wheel.

I’ve spent 100s of hours going down the rabbit hole, and I can offer you the highest-impact resources on bitcoin so you don’t have to spend as much time as I did.

Learning Bitcoin

I recommend the following resources for learning about bitcoin. You don’t necessarily have to consume them in order, though I would recommend getting through the top 5 on the list before moving on.

The Bullish Case for Bitcoin - a concise read on the opportunity of bitcoin.

The Ultimate Argument for Bitcoin - a podcast with Anthony Pompliano (Pomp) and Murad Mahmudov.

The Bitcoin Standard - a more in-depth read on the history of currencies, what money represents, how bitcoin works, and more.

The Price of Tomorrow - not about bitcoin specifically. Explores the world of inflationary monetary policy vs. deflationary technology, and why our debt-fueled economies are unsustainable. Fascinating read.

But how does bitcoin actually work? - Animated YouTube explanation.

Philosophy of Bitcoin From First Principles - a fascinating 4-hour podcast with Lex Fridman and Robert Breedlove. This conversation will absolutely blow your mind, and I could not recommend it more.

The Saylor Series - a podcast series with Robert Breedlove and Michael Saylor (CEO of MicroStrategy) about bitcoin, but it’s also much more than bitcoin. It’s about how humans have advanced through the ages by harnessing energy more efficiently and why energy money makes sense. It will take you a while to get through all 13 episodes (current series length). The series was a game-changer for me.

Bitcoin Net Zero - a recent paper by Nic Carter and NYDIG on how bitcoin is saving people in the harshest economic environments around the world and why bitcoin’s energy consumption is not a problem.

This Machine Greens - A new 30-minute documentary discussing bitcoin’s energy consumption and how it is changing the world of energy for the better.

Storing Bitcoin - a guide on storing bitcoin (or any crypto) securely. If you invest a considerable sum of money into any cryptocurrency, I would highly recommend “cold storage” / self-custody where you cannot get hacked. If you hold crypto in a “hot wallet” such as buying and holding on Coinbase, your funds are lost forever if they get hacked and your crypto is stolen.

Crypto security is a serious topic. There are risks associated with holding your crypto on an exchange like Coinbase (getting hacked), but there are also risks associated with holding crypto in cold storage (you messing it up).

There are also lots of scams. Never give anyone your private key or recovery phrase. Never type those things into a browser. Do not fall for any private messages or offers to make you quick money (like the ‘deposit 1 bitcoin and get 2 back’ scams).

In the future, it will be easier to buy and store crypto securely. For now, early adopters have to get a little technical and take precautions with significant sums invested.

How to Buy Bitcoin

If you want the cheapest recurring purchase platform to buy BTC with, I’d recommend Swan Bitcoin. Use the link here to get a $10 bonus and the eBook Inventing Bitcoin.

I use Swan to buy every single day. The platform is easy to use and will save you tons of money on fees for recurring purchases, especially if you are buying in low dollar amounts.

The bitcoin is held in your name in cold storage (secure) at Prime Trust, and you can set up automatic withdrawals to your own wallets when you’re ready to take that step.

If you’re making lump sum, high-value purchases ($10,000+), then Coinbase Pro is probably the play.

If you make it through all of these readings/videos/podcasts and aren’t on board, then so be it!

I bet that the opposite will happen, and your entire view of money and the world will change for the better.

At the very least, you will be more informed than 99% of people around you.

I hope you enjoyed this post and also enjoy the resources I’ve linked above! They’ve changed my life and my understanding of many different topics.

In the bitcoin world, there’s a saying: “you can’t change bitcoin, but bitcoin will change you.”

It may sound scary, but what they mean is that bitcoin will pull you into learning about so many different fields. It truly makes you a smarter human being, even if you don’t end up investing a single dollar in any cryptocurrency.

Please reply with any questions you may have! I’d be happy to help however I can.

Until next time.

-Chris

Chris, excellent write up. Very noble of you to take the time to attempt to convert "no-coiners" or those un-initiated yet. I was actually deep into crypto first and came to you for option knowledge. Very cool to see a genuine person trying to uplift his audience with crypto entry. Really the only thing I regret with crypto is not starting sooner and your bit about still being early is massively important for people to understand. FOMO tastes bad but so does regret.

Any strong arguments against $GBTC for those who don’t want to deal with opening another brokerage account or wallets?